As we enter the final stretch of 2025, global markets are navigating a complex mix of monetary policy uncertainty, elevated equity valuations, crypto volatility, and a shift towards defensive positioning among both retail, high net worth and institutional investors.

The “ABC Market”

This month’s themes revolve around what I call the “ABC Market”:

Although the fundamental backdrop remains relatively stable, volatility has re-emerged across asset classes. With rate cuts on the table, Bitcoin retracing sharply from historic highs, and most fund managers still underperforming the S&P 500 benchmark, investors are shifting towards defensive, yield-oriented portfolios ahead of year-end.

This report outlines the key drivers shaping markets in November, the risks investors should monitor, and recommended positioning for Q4.

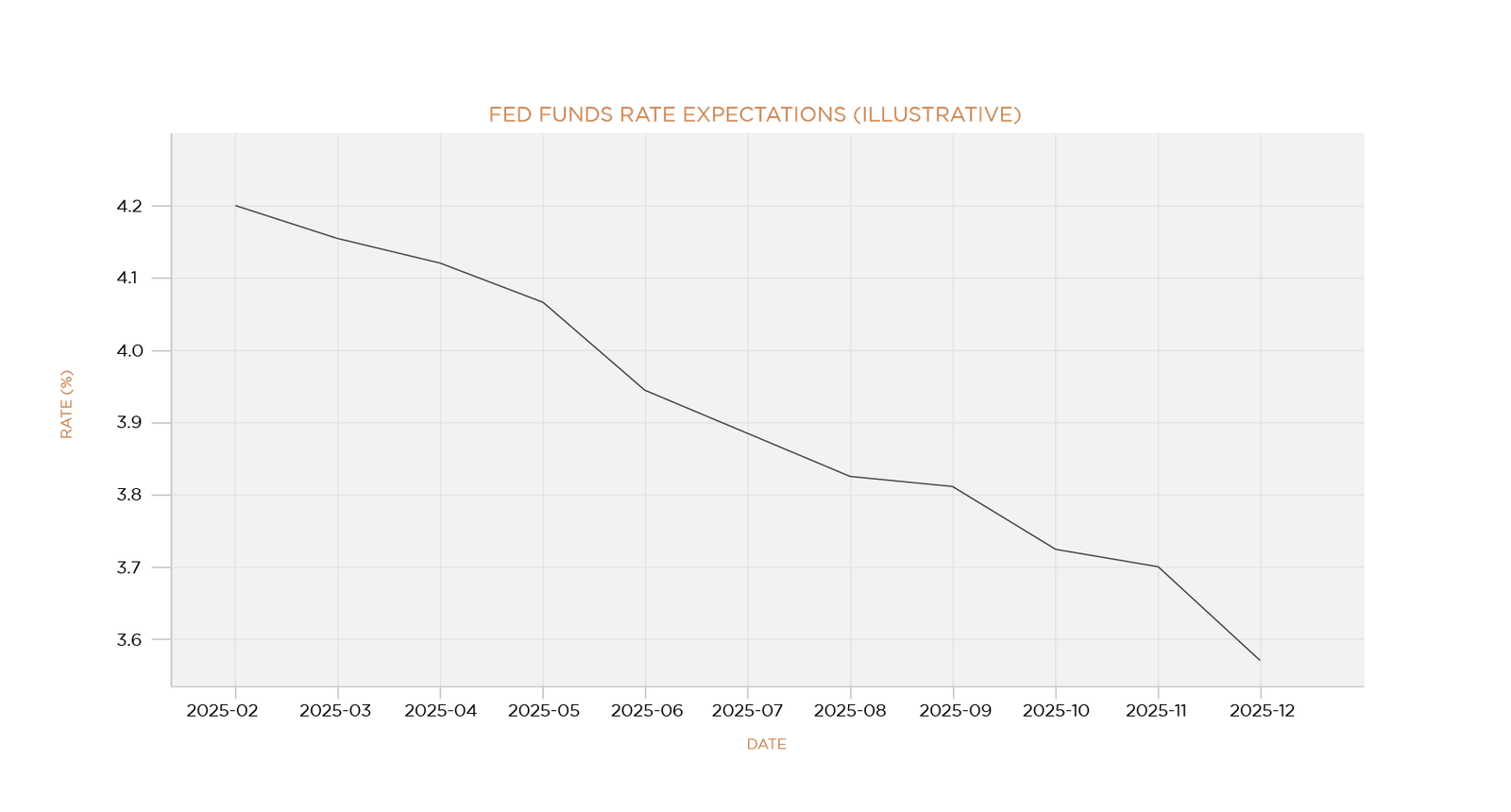

Fed Rate Cut Expectations

Markets currently price a high probability of a 25 bps rate cut at the mid-December FOMC meeting. As of early November:

Source: https://fred.stlouisfed.org/series/FEDFUNDS

The Fed’s challenge is balancing slowing economic momentum with re-anchoring inflation expectations. Equity markets have been supported by the belief that the Fed will deliver at least one more cut before year-end.

However, high rate-cut expectations also create fragility. If the cut does not materialise or is delayed, risk assets may experience a sharp repricing.

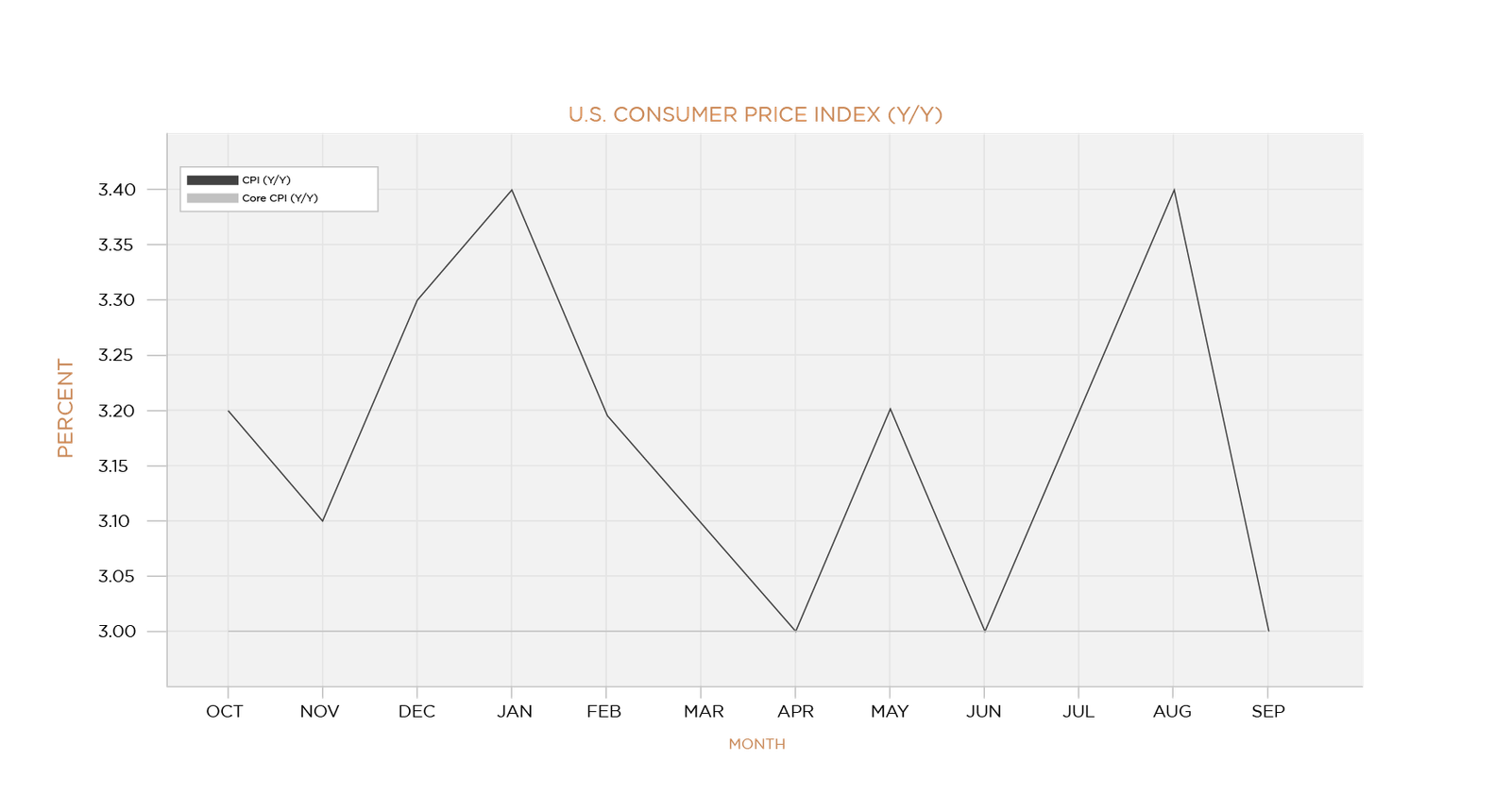

Source: https://www.bls.gov/cpi/

This chart highlights the year‑on‑year trend in headline CPI and Core CPI. The significance lies in the Fed’s policy reaction function: stable or falling inflation increases the probability of rate cuts, reduces bond market volatility, and influences equity sector performance. With both CPI and Core CPI hovering around 3%, markets remain highly sensitive to inflation surprises that could shift the December rate‑cut probabilities.

Seasonality: Santa Claus Rally vs. Volatility

Historically, Q4 is favourable for equities due to year-end inflows, tax planning, and seasonal optimism.

But this year:

While a Santa Rally is possible, the path will likely be choppy, especially in risk-sensitive sectors.

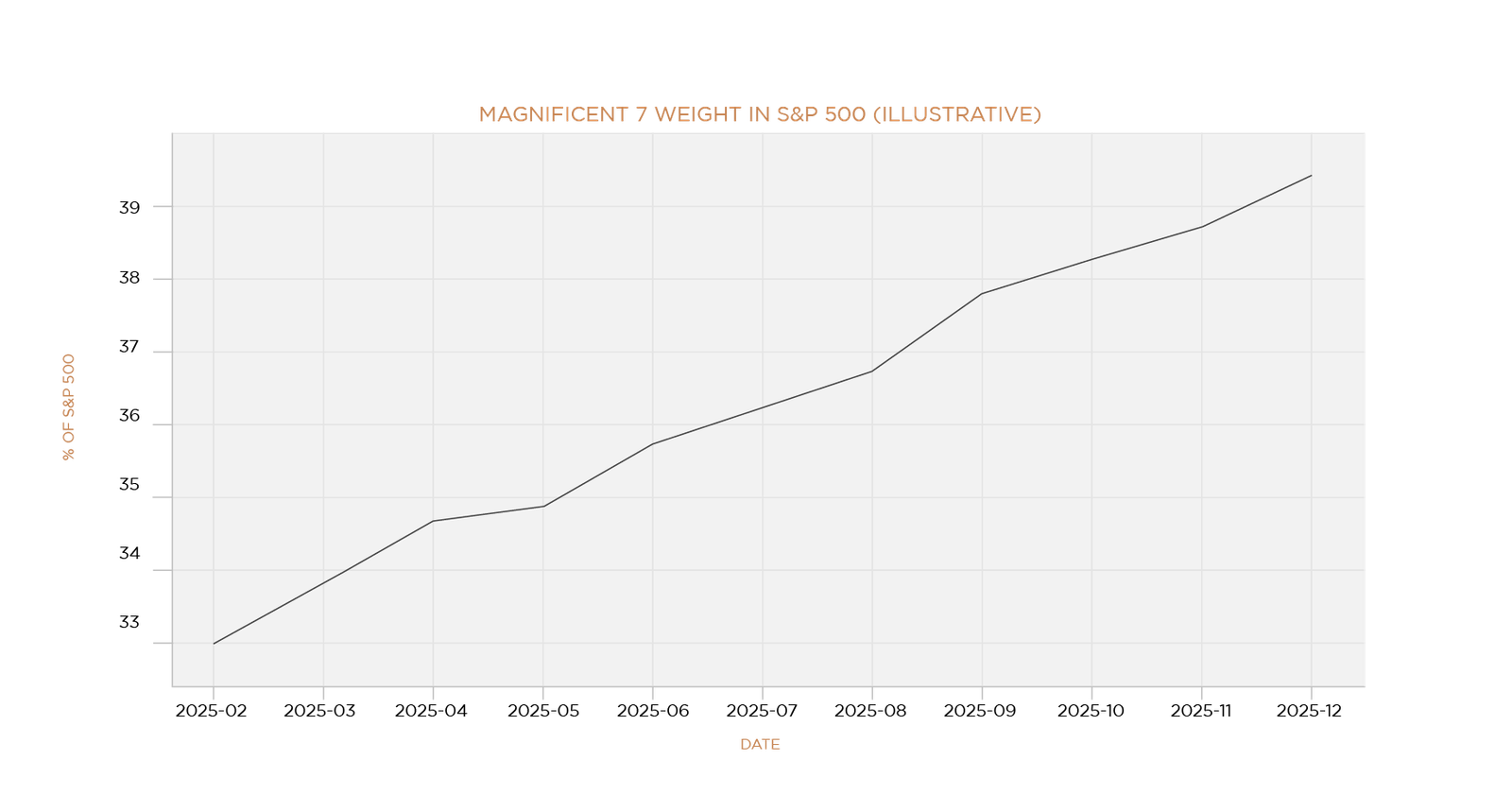

Concentration at Extremes

The Magnificent Seven now account for nearly 40% of the S&P 500, one of the highest concentration levels in market history. These mega-caps have driven most of the index’s performance since April’s pullback.

This creates a two-speed market:

Source: Google

Is This an AI Bubble?

Today’s AI valuations are stretched, but unlike the 2000 dot-com bubble, big tech companies generate real earnings. The risk lies not in collapse, but in future earnings failing to justify the massive capex (capital expenditure) cycle. Companies with weak fundamentals but AI-driven PR are the ones most vulnerable to sharp corrections.

Market considerations:

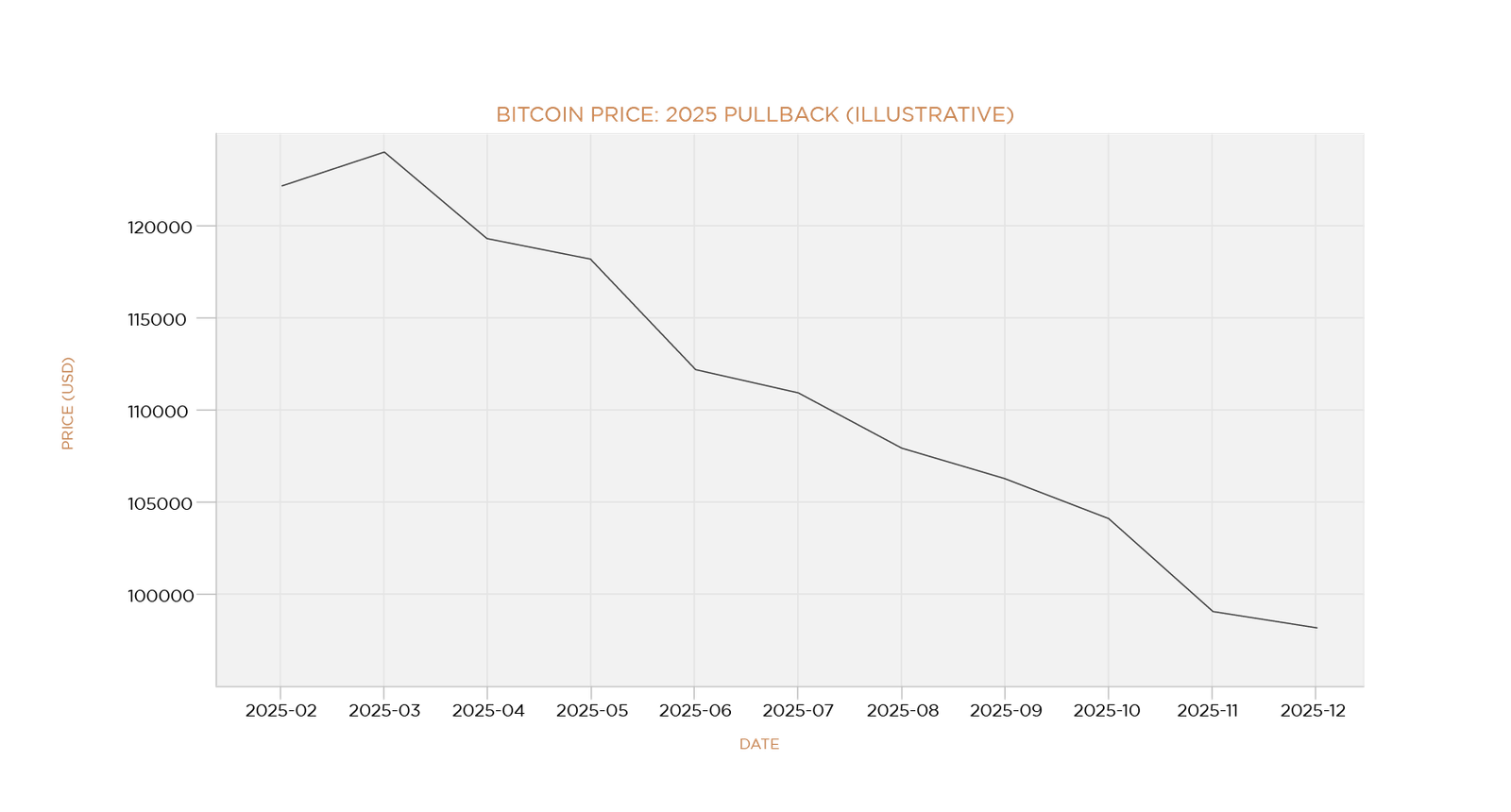

Bitcoin reached an all-time high above $124,000 earlier this year. But the recent reversal has been violent:

This pullback mirrors broader risk-off sentiment across high-beta assets.

Source: Google

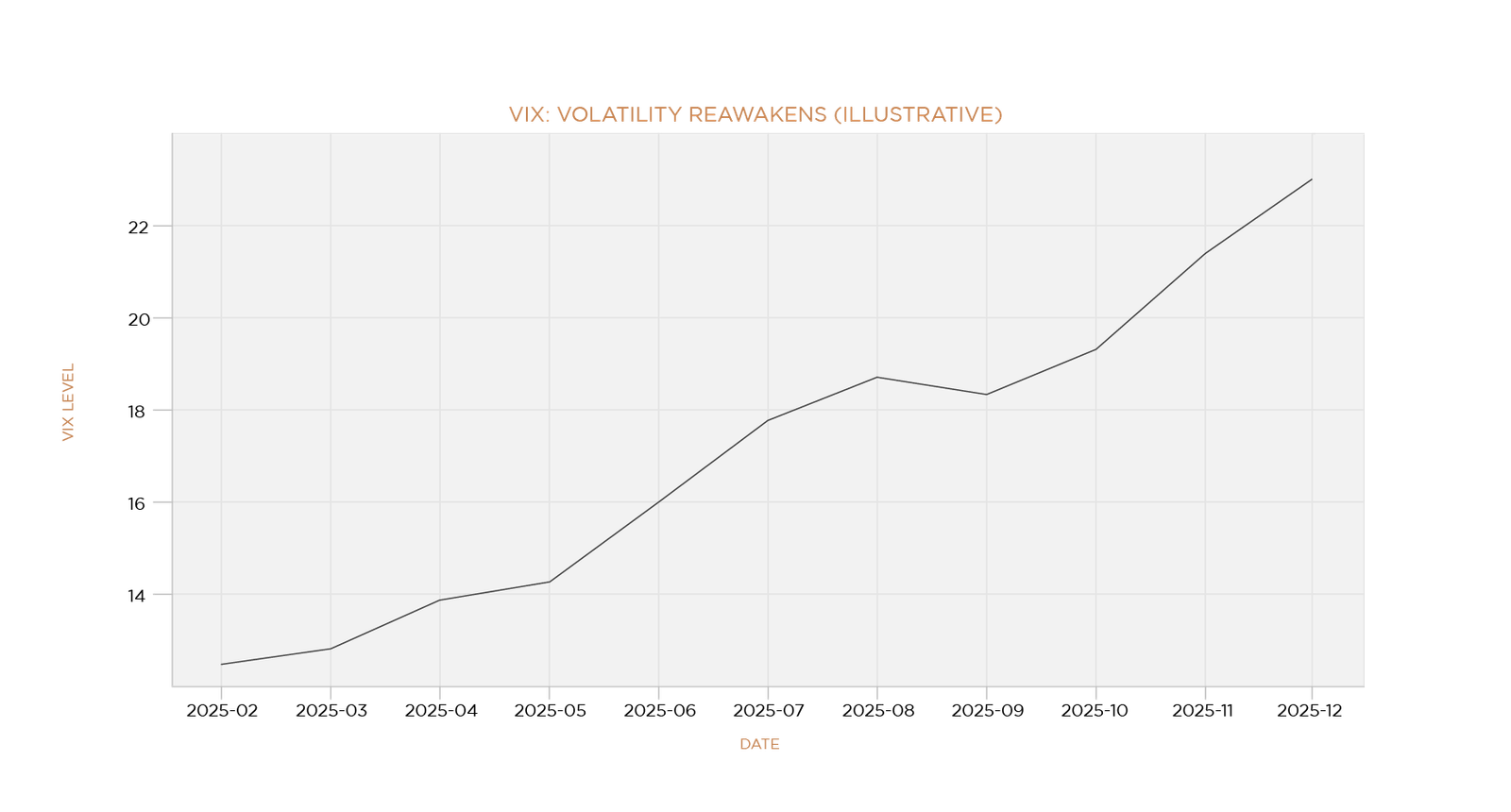

The VIX Index has climbed from its summer lows, reflecting increased hedging demand.

When VIX spikes:

Source: Google

The U.S. just ended its longest government shutdown in history (43 days). Delayed economic data and political dysfunction add risk premia to markets.

Fixed income remains attractive as yields stabilize and the probability of rate cuts increases.

Markets remain sensitive to AI narratives, macro data, and political risk. Defensive positioning and disciplined portfolio management will be key heading into 2026.

Commentary by Warren Poon at AIX Investment Group

Disclaimer: The above market analysis/information is recreated for information and knowledge purposes only under personal capacity, however it does not constitute any liability or obligation upon the readers or the firm to take investment decisions.