As we approach year-end, markets are sending a clear message: this is not a time for greed or gamified risk-taking. While rate cuts and liquidity measures appear supportive on the surface, volatility across equities, crypto, and macro indicators suggests investors should prioritise discipline, profit-taking, and portfolio rebalancing over speculation.

Investing is compounding.

Trading for excitement is consumption.

The difference matters most at turning points.

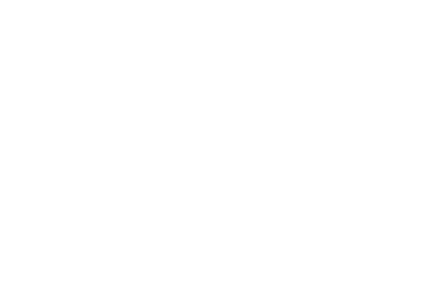

What the chart shows

Why it matters

Even high-quality, AI-exposed tech names are not immune to valuation resets. This reinforces the importance of selling strength, not chasing headlines, particularly in crowded trades.

![]()

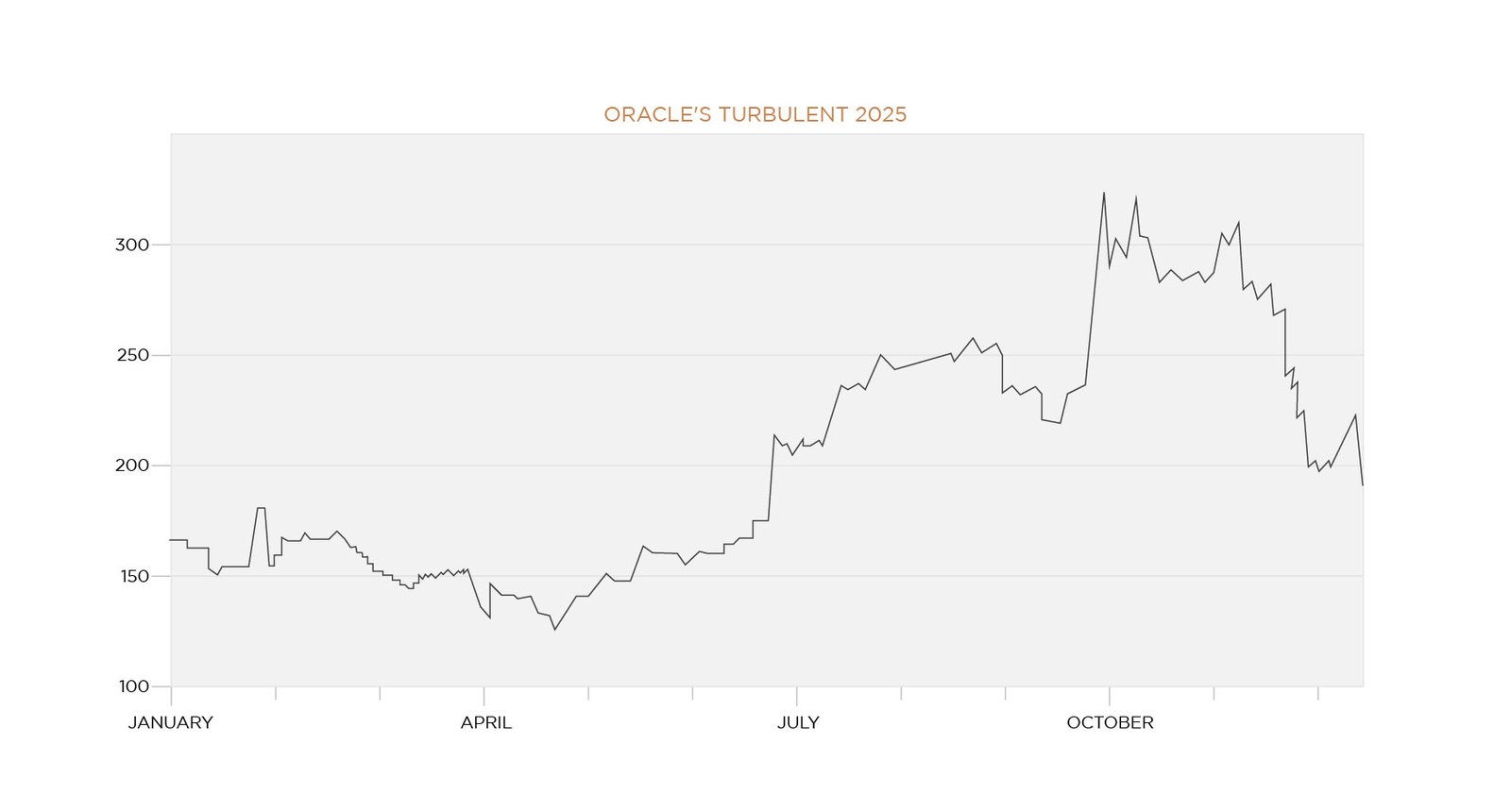

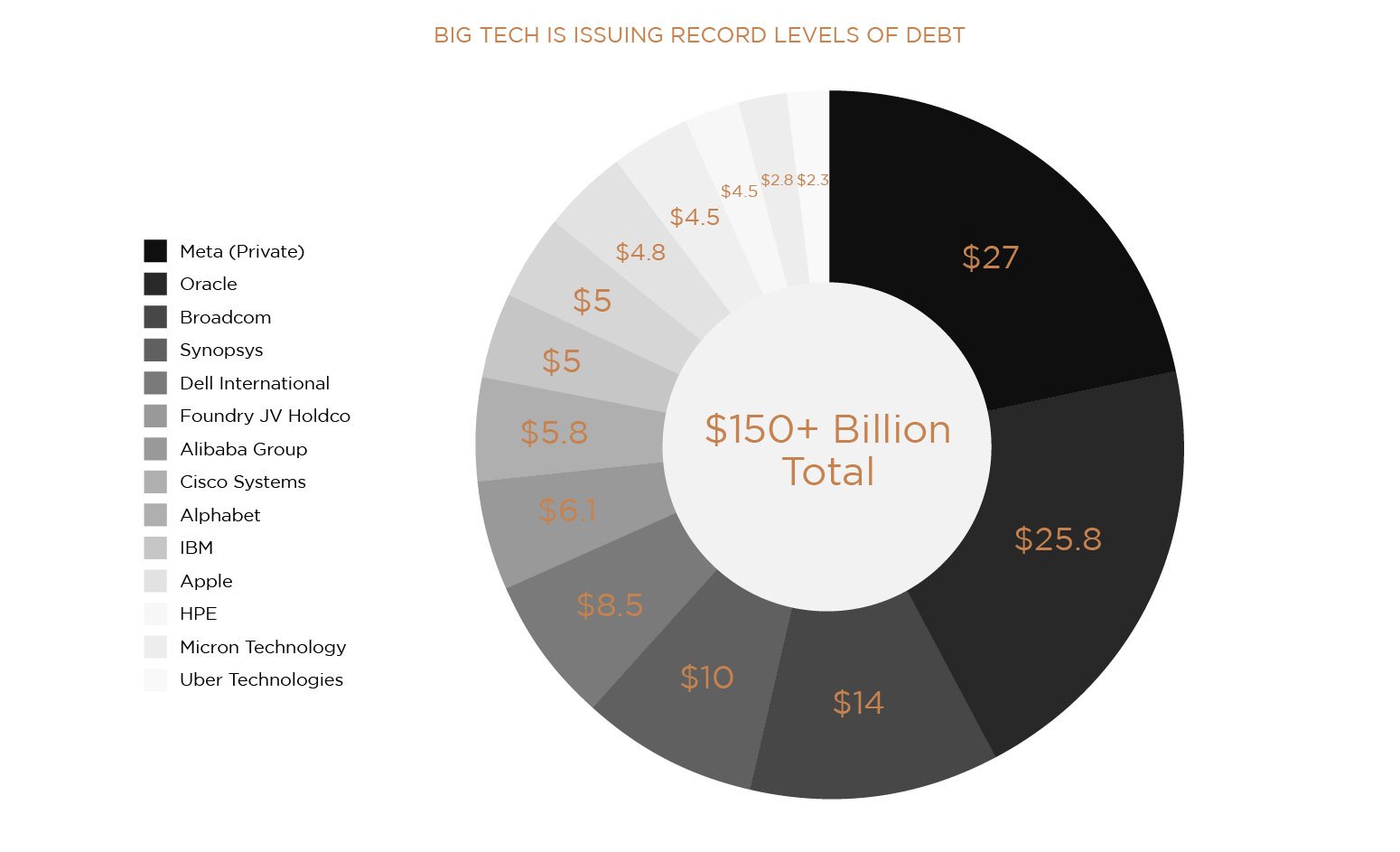

What the chart shows

Why it matters

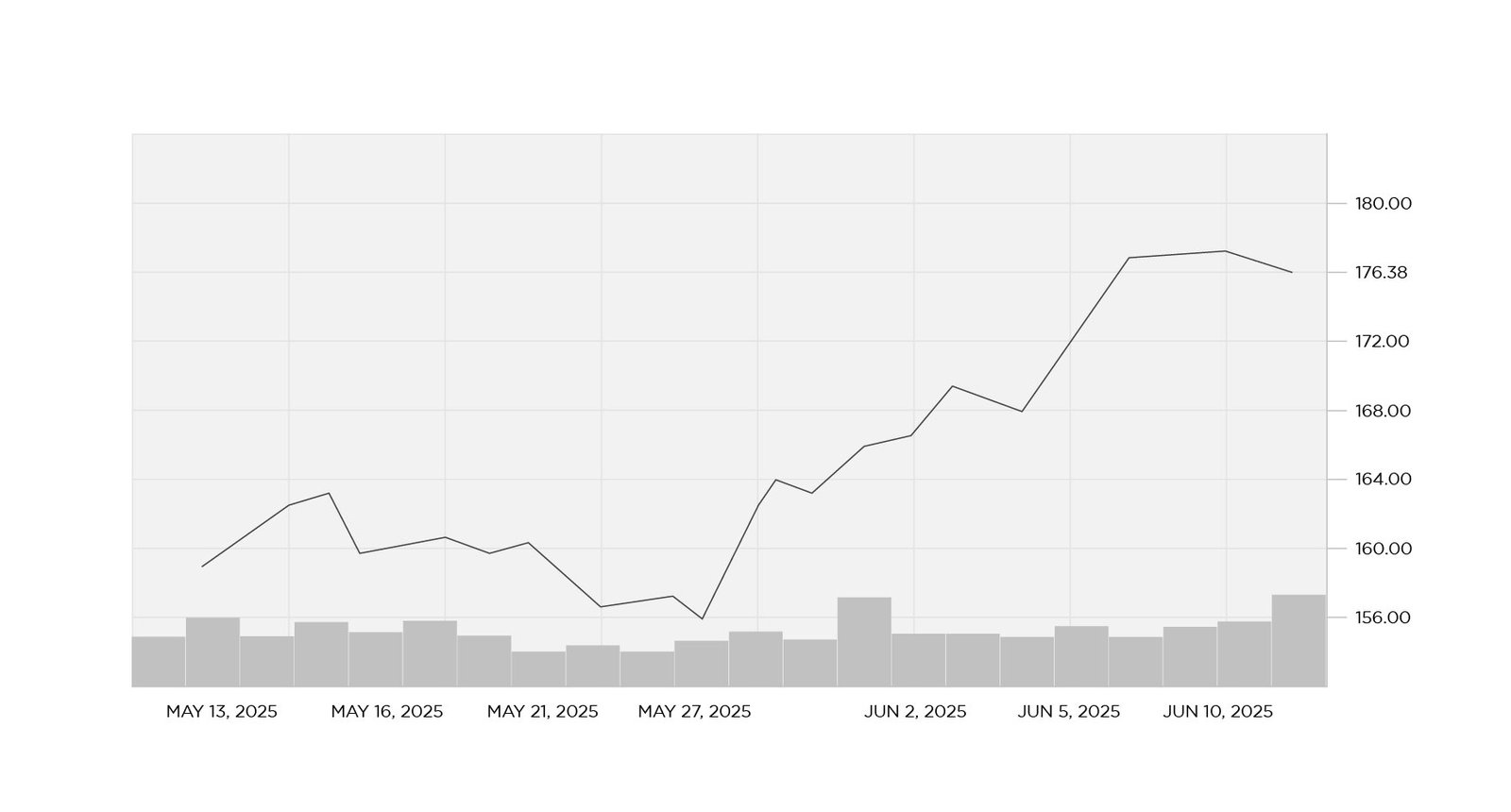

Cooling wage pressure gives the Federal Reserve room to cut rates. However, this also signals slowing real economic momentum, not an acceleration toward a growth boom.

What the chart shows

Why it matters

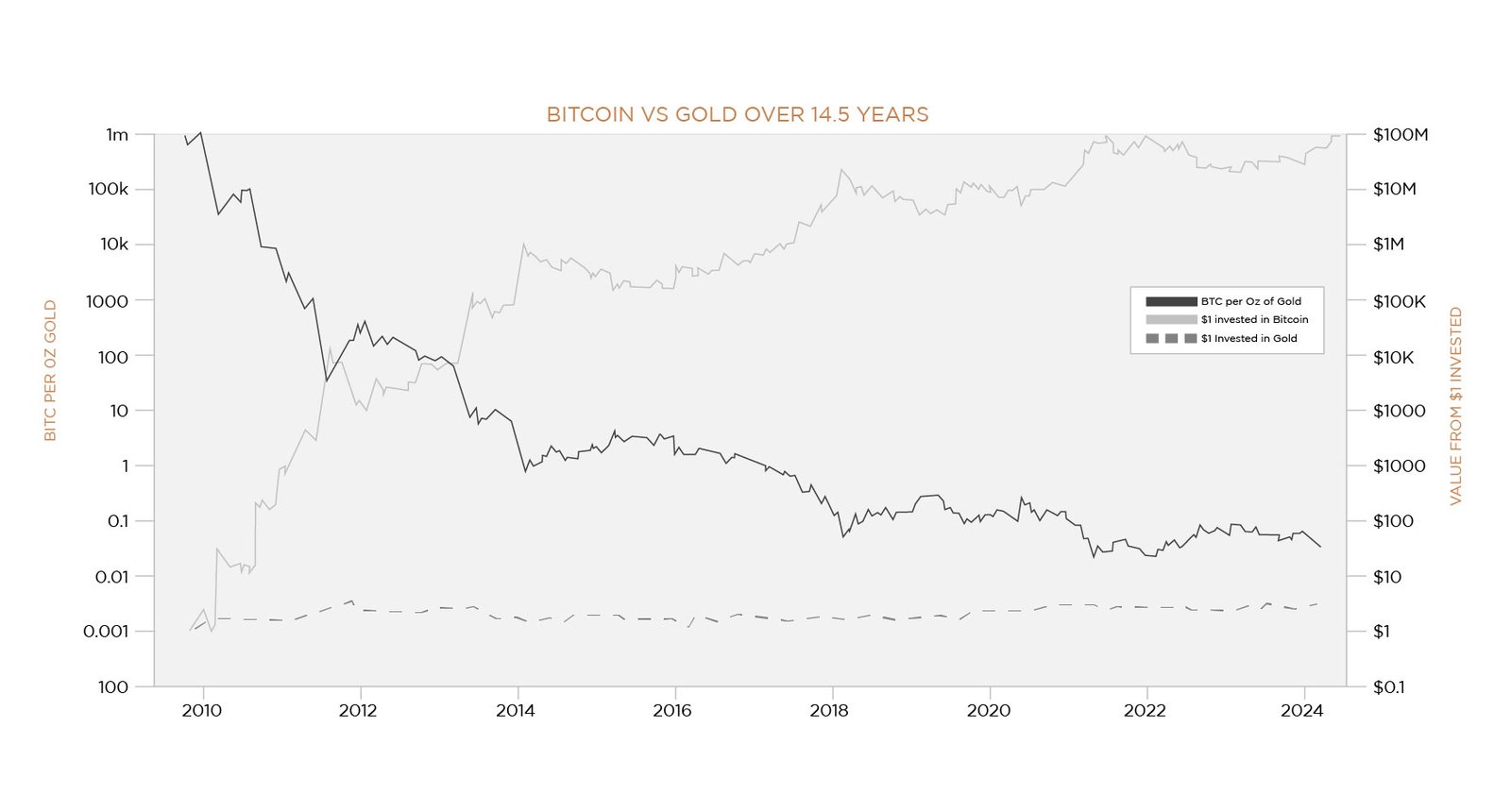

Bitcoin remains a high-volatility, asymmetric asset. It may be suitable for small, actively managed allocations, but it is not a substitute for stability or passive capital preservation.

What the chart shows

Why it matters

Leading technology firms are proactively locking in capital ahead of rate uncertainty and to fund long-term AI infrastructure. Strong balance sheets benefit — weaker “story stocks” do not.

The Federal Reserve cut rates by 25 basis points to a target range of 3.50%–3.75%.This should be viewed as a hawkish cut, easing policy without signalling the start of an aggressive or sustained cutting cycle.

In parallel, the Fed has begun purchasing approximately $40 billion (Into Q1 2026) in Treasury bills, effectively ending quantitative tightening, though officially framed as “liquidity management.”

Key takeaway: This represents stealth liquidity, not stimulus. It may support markets at the margin, but it does not eliminate volatility or downside risk.

A growing number of investors, particularly younger participants, are increasingly treating markets as casinos, social media feeds, and entertainment platforms. This behaviour creates short-term dopamine, not long-term wealth.

Trading creates excitement. Investing creates compounding. Gambling creates decay. Real wealth is built slowly, quietly, and often uncomfortably — not through constant activity.

Markets reward patience, not activity.

As we move into 2026, the objective is not to chase returns, but to protect capital, compound intelligently, and avoid being whipsawed by volatility.

Discipline beats dopamine.

Commentary by Warren Poon at AIX Investment Group

Disclaimer: The above market analysis/information is recreated for information and knowledge purposes only under personal capacity, however it does not constitute any liability or obligation upon the readers or the firm to take investment decisions.