Two phrases are increasingly being used by investors and geopolitical analysts to describe the current global environment. They sit at opposite ends of the same spectrum and markets are now being forced to decide which one reflects reality.

FAFO captures the idea that the world is moving from rhetoric into consequence.

It reflects a shift where:

In market terms, FAFO means:

FAFO describes a world where actions create second- and third-order effects across commodities, trade routes, currencies, and capital markets.

TACO represents the opposing belief that has dominated markets in recent years.

It assumes that despite aggressive rhetoric:

Under TACO, markets repeatedly fade fear, buy relief, and assume stability will reassert itself.

This mindset has underpinned years of complacency, where geopolitical shocks were treated as tradable noise rather than structural change.

2026 is forcing investors to confront whether the old playbook still works.

Recent developments — from military involvement in Venezuela, to renewed pressure on Iran, to destabilisation of alliances, and intensifying Taiwan rhetoric — increasingly point toward a world that resembles FAFO rather than TACO.

Markets are already responding:

This report examines whether portfolios are positioned for a continuation of the old regime, or the emergence of a new one.

We are entering 2026 in a fundamentally different market regime. Markets are no longer driven primarily by liquidity and multiple expansion. They are being driven by:

The first half of 2026 is shaping up to be defined by:

This is not an environment for blind beta exposure.

In simple terms: this is not a market where you can just buy “the market” and assume it will carry you higher. Volatility, geopolitics, and policy risk mean portfolios must be structured, selective, and income-aware.

It is an environment for defensive structuring, income generation, and selective long-term accumulation.

Trump’s leadership style is consistent and explicit: U.S. national interest above alliances. Hard power before diplomacy. Three developments highlight this shift.

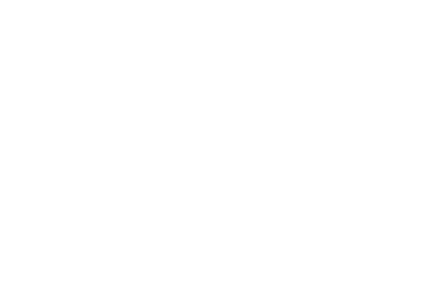

Venezuela holds the largest proven oil reserves in the world, yet its exports remain structurally constrained.

Source: U.S. Energy Information Administration (EIA).

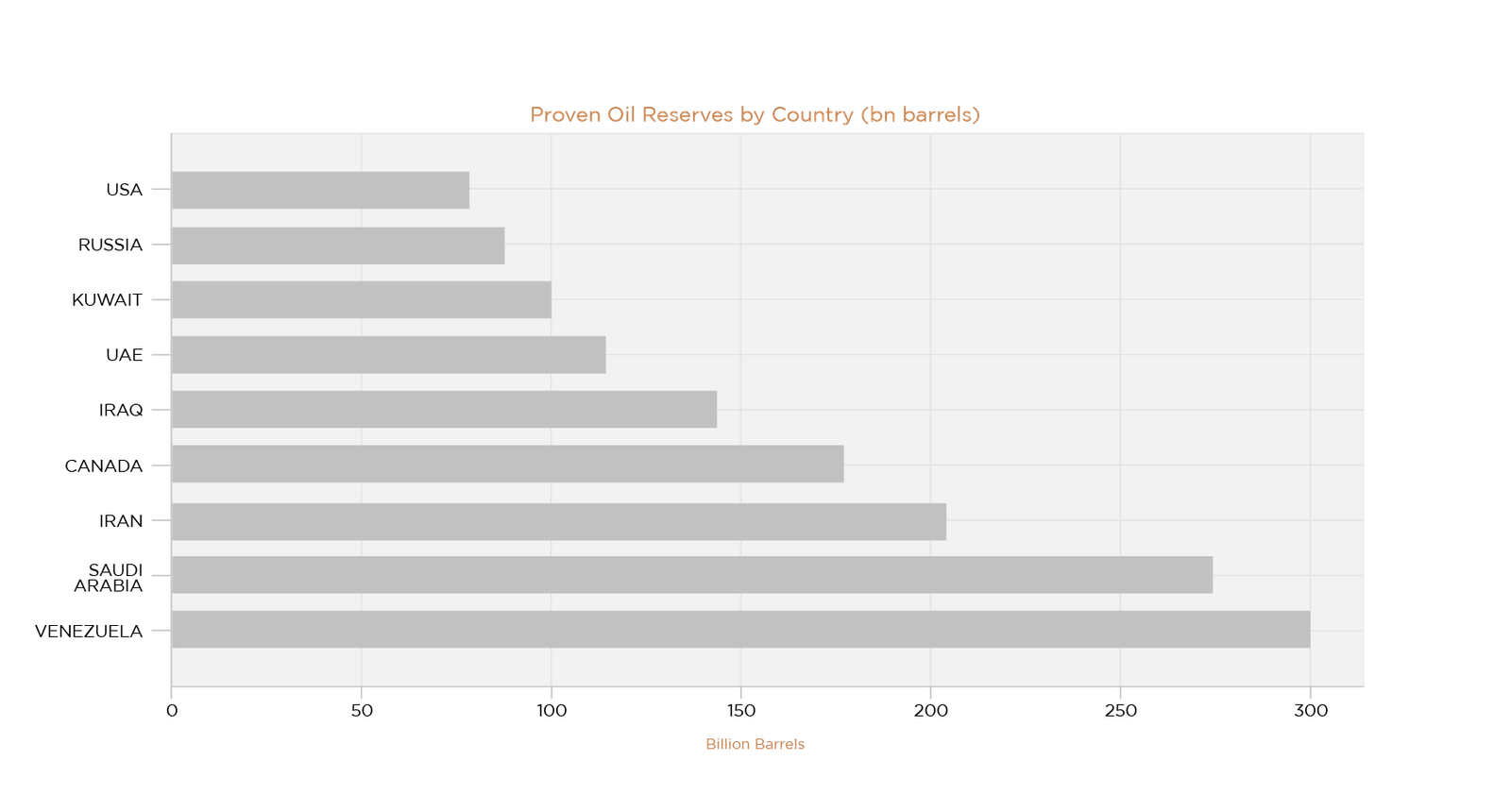

Despite sitting on ~300bn barrels of reserves, Venezuela’s production and export capability has collapsed due to sanctions, under-investment, and political isolation.

The recent U.S. military intervention and seizure of strategic control represents more than regime pressure. It establishes a precedent: Energy security enforced through military leverage.

This matters because:

This is not ideological conflict. This is resource control.

Sources: U.S. Energy Information Administration (EIA), Reuters, Hellenic Shipping News

China’s oil dependence remains one of its most acute vulnerabilities. Approximately 80–90% of Iran’s seaborne crude exports go to China, estimated around 1.2–1.4 million barrels per day. At current oil prices, this represents $35–45+ billion per year of strategic energy flows.

Any disruption to Iran directly transmits into China’s economic system.

Which means Middle East instability is no longer regional. It is systemic.

Sources: Reuters, Kpler, Vortexa, EIA

Multiple defence and intelligence assessments continue to identify 2027 as a credible window for a Chinese amphibious operation against Taiwan based on force readiness and logistics capability.

Trump’s “not in my backyard” approach — intervening decisively in the Western hemisphere while rhetorically warning China over Taiwan — may paradoxically reinforce Beijing’s own geopolitical logic: “If Venezuela is America’s backyard, Taiwan is ours.”

This is the double-edged sword of FAFO geopolitics.Strength deters, but precedent empowers.

Sources: CSIS, RAND, U.S. Department of Defense, Reuters

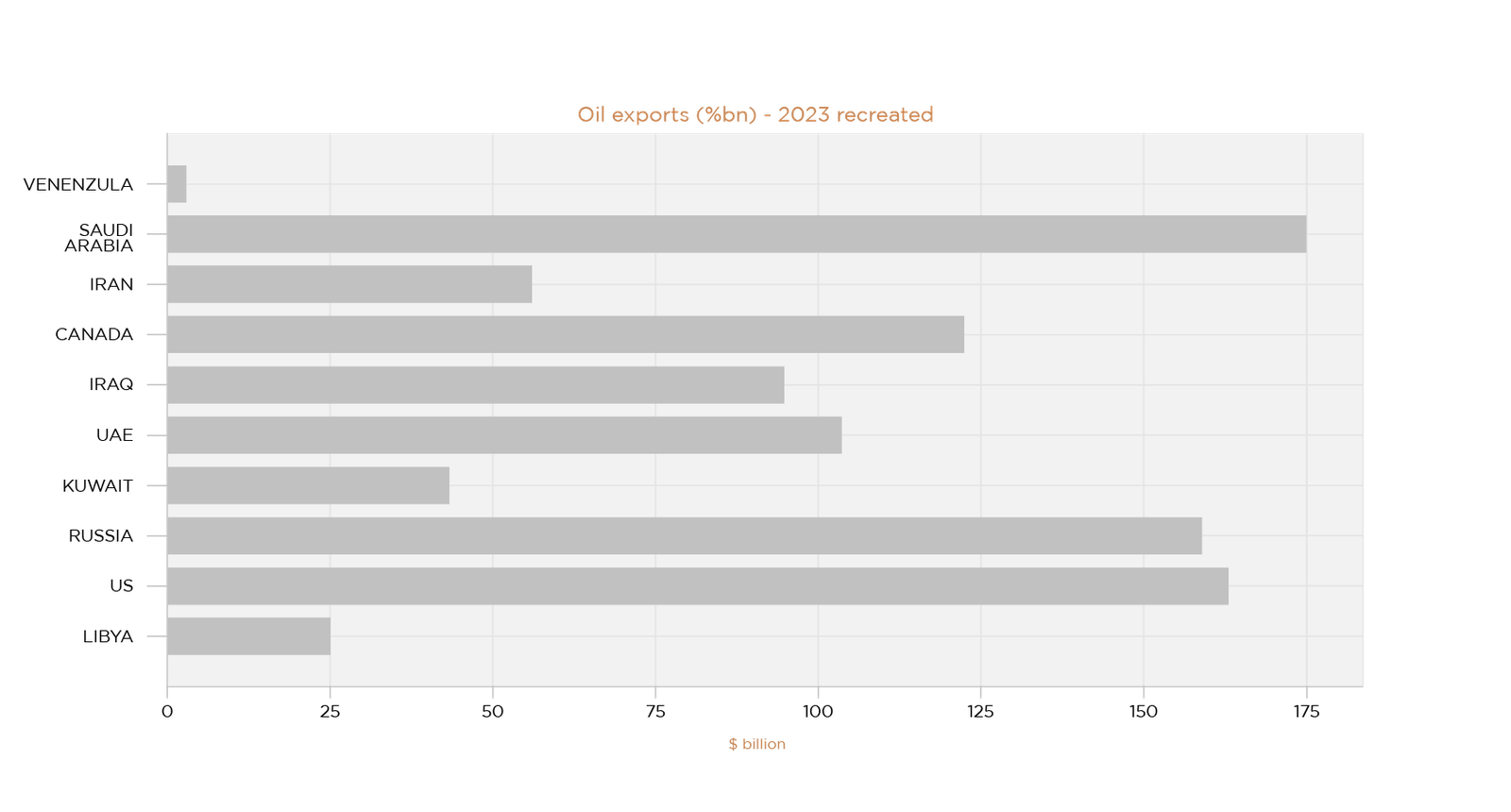

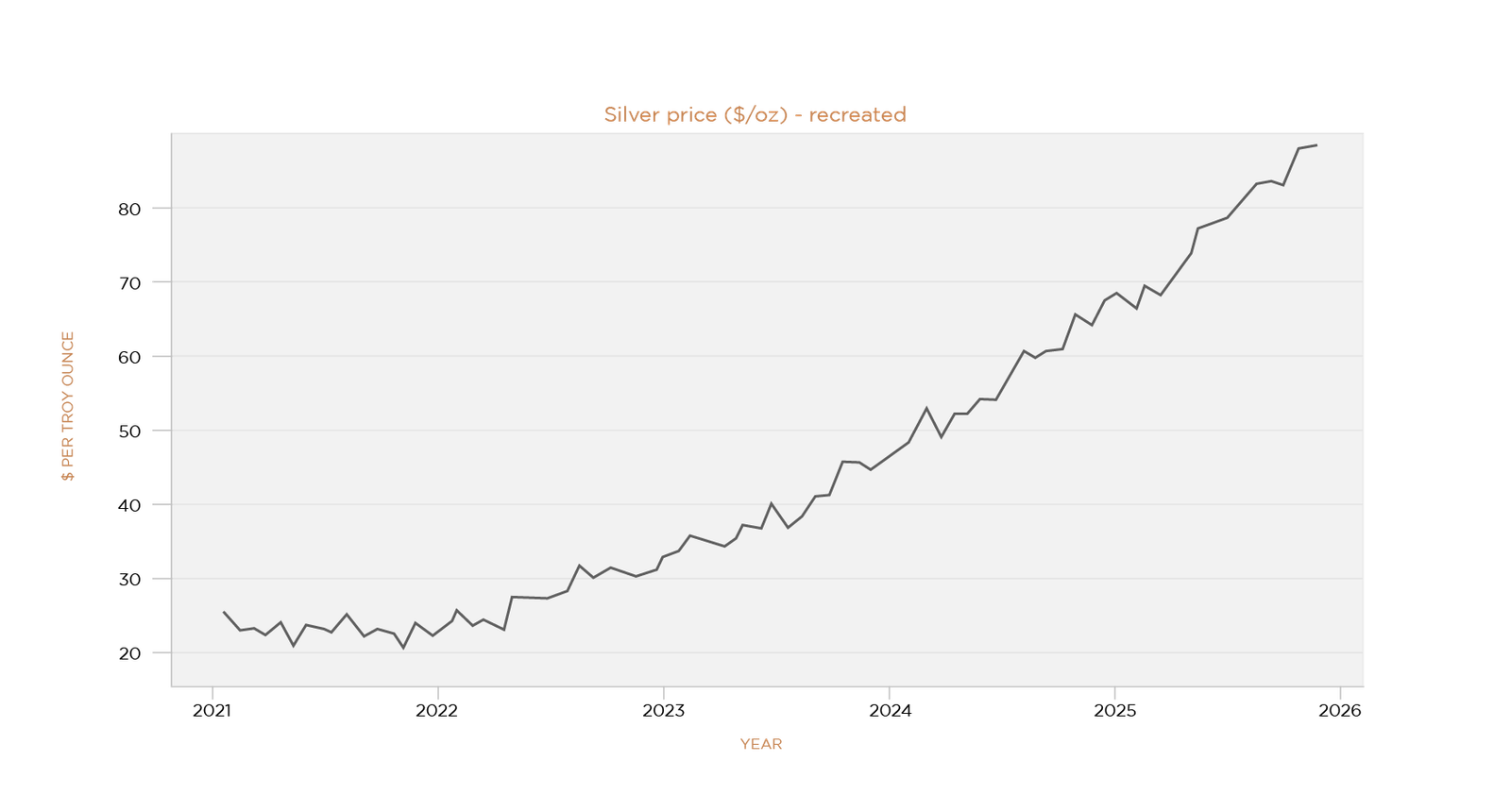

Gold and silver are not rising quietly.They are repricing structurally.

Gold has surged to record levels above $4,500/oz. Silver has broken through multi-decade resistance.This move reflects three forces:

This is not de-dollarisation. It is risk repricing. Capital is rotating away from promises and toward stores of value.

Sources: Reuters, World Gold Council, LBMA

Markets are no longer pricing interest rates alone. They are pricing institutional risk. With a new Fed Chair expected around May, investors are increasingly pricing the probability of a more dovish Federal Reserve.

A dovish central bank prioritises growth and financial stability over inflation containment, typically implying:

A dovish shift would likely:

But it also risks undermining long-term credibility, which markets are already hedging.

Sources: Federal Reserve, CME FedWatch, Reuters

The S&P 500 has delivered three consecutive years of double-digit returns.

That is statistically exceptional.

Consensus expectations for 2026 now centre around single-digit returns (≈7–9%), accompanied by:

This is not a crash environment.It is a whipsaw environment.

The primary risk is not direction. The primary risk is positioning failure.

Sources: S&P Dow Jones Indices, Bloomberg

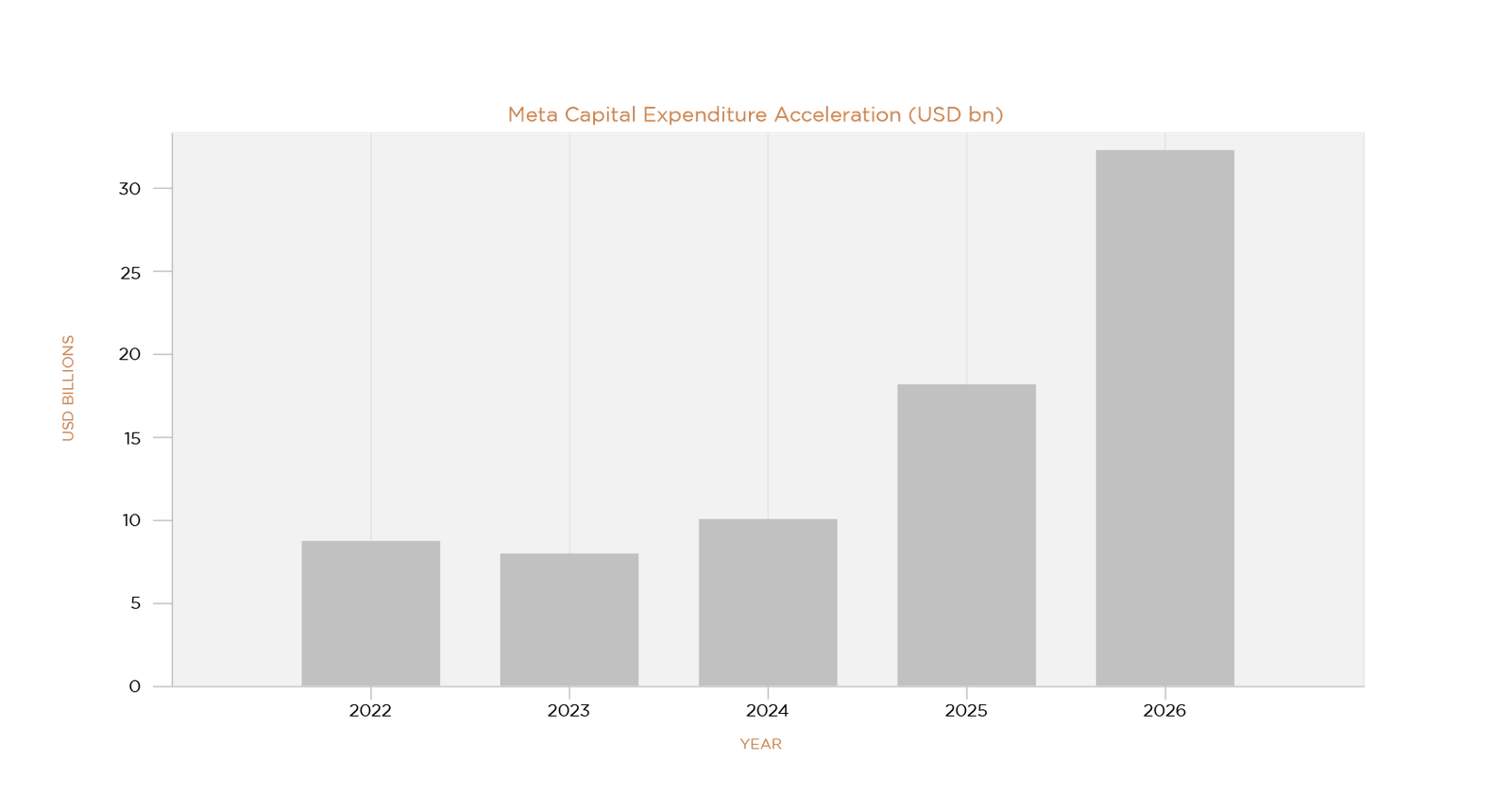

Major technology firms are committing tens of billions annually into:

This is what early-stage capital formation looks like. Valuations will fluctuate. Stocks will overshoot and correct. But the capital-expenditure trend confirms that corporate conviction remains intact.

This is why the second half of 2026 is more likely to be earnings-driven rather than liquidity-driven.

Sources: Company reports, Bloomberg, FactSet

2026 is not a “bull or bear” year. It is a fragile or resilient year. The breakdown:

Q1–Q2 2026

Q3–Q4 2026

1. Defence before offence

2. Income is not optional

3. Diversification away from pure beta

4. Selective long-term accumulation

This is how portfolios survive unstable regimes while still compounding.

Commentary by Warren Poon at AIX Investment Group

Disclaimer: The above market analysis/information is recreated for information and knowledge purposes only under personal capacity, however it does not constitute any liability or obligation upon the readers or the firm to take investment decisions.